Startups must expertly balance short-term and long-term capital requirements through strategic planning. Assessing capital needs involves distinguishing immediate operational demands from future growth objectives, guided by capital forecasting that leverages historical data, industry trends, and competitive insights. This enables founders to make informed decisions on investments and resource allocation, ensuring efficient capital utilization while attracting investors. Balancing short-term funding for survival with long-term investments in growth fosters stability and drives sustainable expansion.

Securing the right capital at the right time is vital for any startup’s success. This comprehensive guide navigates the complex world of startup finance, focusing on understanding the nuanced difference between short-term and long-term capital requirements. We delve into assessing capital needs through a detailed checklist, developing robust capital planning strategies, balancing inflows and outflows for sustainable growth, and optimizing capital efficiency. By mastering these aspects, startups can secure funding, foster growth, and achieve longevity.

- Understanding Short-Term vs Long-Term Capital Requirements

- Assessing Startup's Capital Needs: A Comprehensive Guide

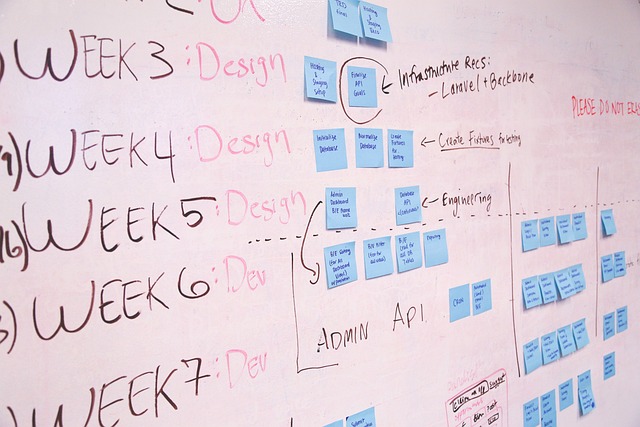

- Developing Effective Capital Planning Strategies

- Balancing Capital Inflows and Outflows for Sustainable Growth

- Optimizing Capital Efficiency for Startup Success

Understanding Short-Term vs Long-Term Capital Requirements

Startups often find themselves in a delicate balance when it comes to managing their capital requirements—a dynamic interplay between short-term and long-term financial needs. Assessing capital needs involves a strategic approach, where entrepreneurs must consider both immediate cash flow demands and future growth objectives. Short-term capital is typically required for day-to-day operations, inventory, or covering expenses during the initial stages of business setup. On the other hand, long-term capital planning strategies are essential for scaling up, research & development, market expansion, or acquiring assets that will drive sustained growth.

Capital forecasting plays a pivotal role in optimizing capital efficiency. By evaluating historical data and projecting future trends, startups can make informed decisions about when and how much capital to secure. Balancing short-term versus long-term capital needs is an art; it involves prioritizing investments, managing cash flow diligently, and ensuring that financial resources are allocated effectively to support both immediate survival and long-term viability. This strategic planning enables startups to navigate the funding landscape with confidence, attracting investors who recognize the potential for significant returns on their investment.

Assessing Startup's Capital Needs: A Comprehensive Guide

When starting a new venture, understanding your capital requirements is crucial for successful navigation in the early stages. Assessing capital needs involves distinguishing between short-term and long-term financial goals. Short-term capital often covers immediate expenses, inventory acquisition, or hiring initial personnel. In contrast, long-term capital may be required for expansion plans, research & development, or entering new markets. A comprehensive guide to assessing capital needs should include detailed planning strategies that balance these varying demands.

Capital planning strategies must consider dynamic market conditions and the startup’s unique growth trajectory. Accurate capital forecasting involves analyzing historical data, industry trends, and competitive landscape insights. This process enables founders to optimize capital efficiency by making informed decisions on investments and operational costs. By thoughtfully balancing immediate and future financial needs, startups can secure the right amount of capital to fuel their journey without overspending or missing out on strategic opportunities.

Developing Effective Capital Planning Strategies

Startups often face a delicate balance when it comes to capital planning, especially in managing short-term vs long-term financial needs. Assessing capital requirements is a critical first step; this involves scrutinizing business objectives and forecasting future cash flows to determine both immediate and upcoming funding gaps. By understanding these needs, entrepreneurs can develop robust capital planning strategies that optimize resources effectively.

Capital planning strategies should be dynamic, integrating short-term tactics for quick capital injection and long-term approaches for sustainable growth. Balancing capital needs requires meticulous monitoring of expenses and revenue projections, enabling founders to make informed decisions on when and how to access funding sources. This may involve optimizing capital efficiency through strategic investments, streamlined operations, or innovative financing methods, ensuring the startup remains agile in a rapidly changing market.

Balancing Capital Inflows and Outflows for Sustainable Growth

Securing the right amount and type of capital is crucial for a startup’s long-term success. One key aspect often overlooked is achieving a harmonious balance between short-term and long-term capital inflows and outflows. Startups must carefully navigate this equilibrium to foster sustainable growth. Assessing capital needs involves a strategic evaluation of both immediate financial requirements and future goals, enabling founders to implement effective capital planning strategies.

Effective capital management means optimizing capital efficiency by forecasting future cash flows and managing expenses accordingly. This balancing act ensures that resources are allocated for short-term operational needs while simultaneously investing in long-term growth opportunities. By strategically assessing capital needs and implementing robust capital planning, startups can avoid overspending or underspending, leading to a more stable financial trajectory.

Optimizing Capital Efficiency for Startup Success

Startups often face a delicate balance when it comes to capital management, especially as they navigate the differences between short-term and long-term financial needs. On one hand, immediate capital is required for day-to-day operations, hiring staff, and initial product development. This short-term capital ensures the startup can stay afloat and meet its immediate obligations. However, looking ahead, long-term capital investments are crucial for growth, expansion, and achieving strategic milestones. Optimizing capital efficiency involves a thoughtful assessment of these dual needs.

Effective capital planning strategies require startups to meticulously assess their current and future capital requirements. This includes detailed capital forecasting, considering market trends, competitive landscapes, and the startup’s unique growth trajectory. By balancing short-term and long-term capital needs, startups can make informed decisions on funding sources, whether it’s through bootstrapping, angel investors, venture capital firms, or strategic partnerships. This approach ensures they have the resources to sustain operations while also fueling sustainable growth.